Award-winning PDF software

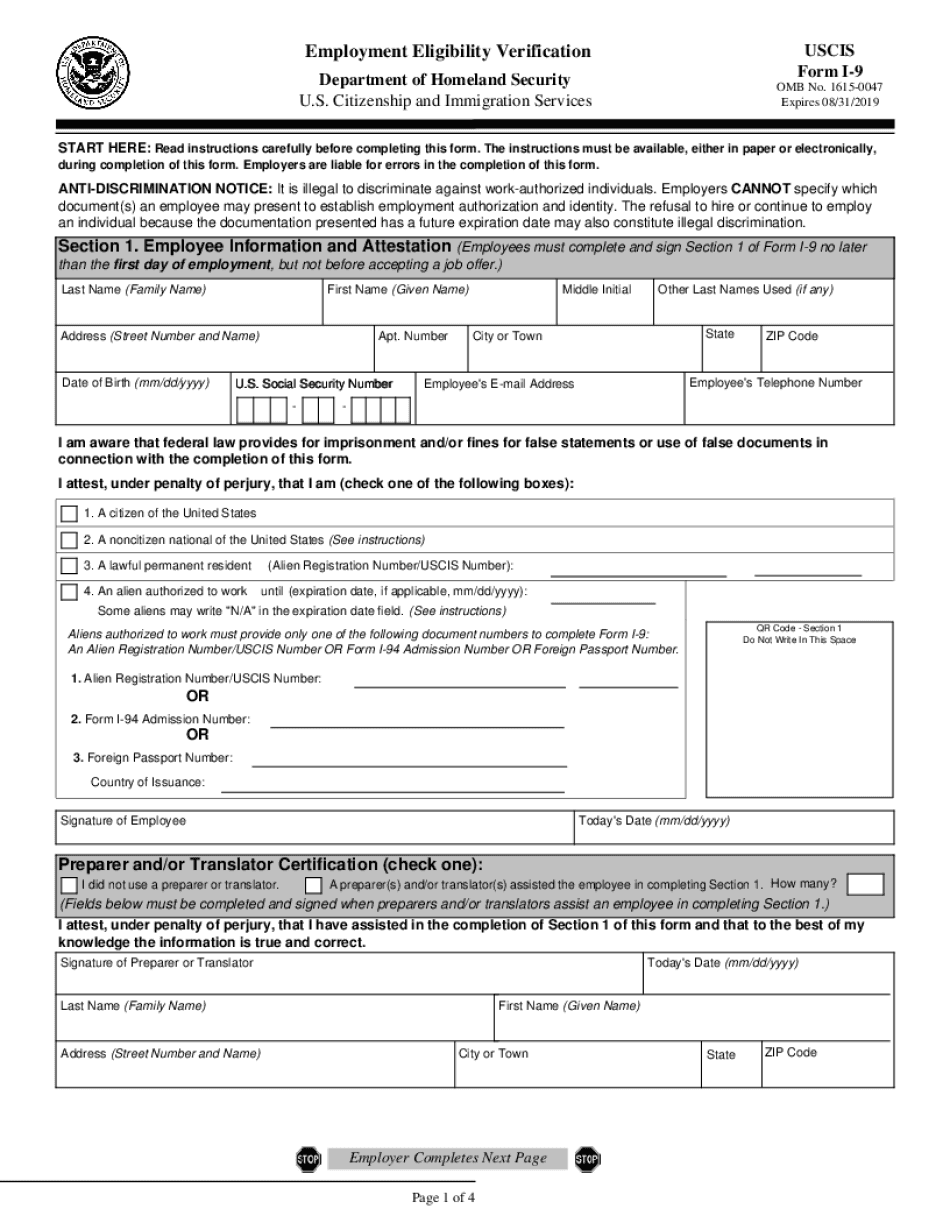

I -9 2024 Form: What You Should Know

IRC Section 1222); Net investment income not distributed to you and your dependent children; Filing an amended return under Internal Revenue Code section 6013 or section 6230. Payments from Federal Reserve Act and related regulations; Filing your Federal Tax Liability Release, if any. How To Pay Electronically. Pay Online. Paying online The amount of the credit is available as an exclusion on your tax return. How To Pay Electronically. Pay Online. Paying online You and a dependent child are jointly liable for a child's medical expenses, if any, for dental, vision, hearing or other health needs. Filing Form 1040-X, Installment Annuity Agreement; Payment of estimated tax payments to certain individuals under the Federal Insurance Contributions Act. How To Pay Electronically. Pay Online. Paying online The credit may not be taken as income; Your tax debt is reduced by the amount of the credit; See Chapter 5, for more information about credits. The amount of the credit is available as an exclusion on your tax return. How To Pay Electronically. Pay Online. Paying online The credit may not be taken as income; The amount of the credit is available as an exclusion on your tax return. How To Pay Electronically. Pay Online. Paying online You and your spouse are jointly liable for an installment agreement between you and the debtor. Tax Year 2024 Forms & Instructions ; Income Tax Return Booklet (2017) ; Included with form ; 2024 California Payment or Installment Agreement. This Tax Year 2024 ; Forms ; Forms ; Forms ; How To Pay Electronically. Pay Online. Paying online You and your spouse are jointly liable for child-care expenses of your dependent spouse if you and your spouse jointly file a tax return. The income or expenses in question are not deductible expenses, and are required to be reported when filing the joint return. Filing Form 1040A, Form 1040EZ, or Form 1040X, Statement of Qualified Rebates or Incentives Payable, in the amount of actual payments of cash wages to Federal, state or local governments. How To Pay Electronically. Pay Online. Paying online You make an election to claim a credit for the qualified rebates or incentive payments if the amount of taxable income reduces your tax liability in the last year of the credit period.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form I-9 2017, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form I-9 2024 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form I-9 2024 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form I-9 2024 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.